Close window | View original article

Sports Stars and Excessive Taxes

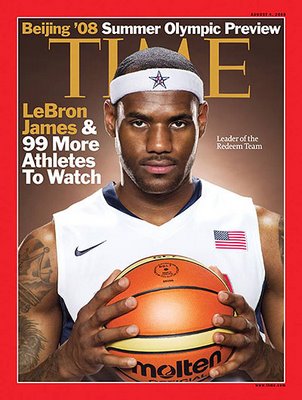

High taxes helped drive LeBron James away from Cleveland.

There are few things in modern life that consume so vast an amount of societal energy, mental awareness, and ordinary people's time as professional sports.

Unfortunately, there are also few things that have so little effect on what you might call the "real world" - the productive economy, the increase of human knowledge, the improvement of daily governance. The "National Felons League" notwithstanding, athletics doesn't even have the same wide-ranging and cultural effects of Hollywood; it is, from the macroeconomic perspective, an unproductive ongoing sunk cost.

But every now and again, something unforeseen but potentially of monumental importance comes flying out of the sports arena. LeBron James might, just possibly, have triggered such an event.

Whiny Millionaires, Greedy Billionaires, and Thieving Politicians

For many decades now, sports stars have been some of the highest-paid Americans. A truly great athlete can collect sums that would make even a CEO blush. However, unlike most CEOs, the athlete's talent and hard work is observed by millions on TV every night; most Americans seem to believe that their sports heroes earn their pay, except when they go out on strike and destroy a season.

In switching to the Miami Heat, Mr. James has not committed that cardinal sin. He has merely exercised the same right that each and every American has: to find the employer willing to pay him the most money and which offers him the highest likelihood of future advancement. He's just done it on a vastly larger scale than most of us will ever do.

What's interesting is the why. Mr. James' long tenure with the Cleveland Cavaliers, combined with growing up in that city, seems to have created an expectation that he'd always stay there.

But to be brutally frank, Cleveland is not much of a city, and the Cavaliers not a compelling championship team. Be fair: would you rather live in Cleveland, or in Miami?

Of course, most of us would move to Cleveland tomorrow if someone offered us $96 million to do pretty much anything there. And for someone who loves the limelight, being offered $96 million to go to Manhattan seems like a dream come true.

But there's one other factor: taxes. According to the Business and Media Institute, citing the New York Post and other sources:

"On a five-year contract worth $96 million -- what he'd get from the Knicks or the Heat -- LeBron would pay $12.34 million in New York taxes." Florida has no state income tax. New Jersey and Ohio, the other reported frontrunners to attract James, also have state income taxes, but they are not as high as in New York. Based on a $96 million contract, James would pay $5.69 million in state taxes if he re-signed with the Cleveland Cavaliers. If he signed with the New Jersey Nets, James would pay $10.32 million in state taxes.

So by going with the Heat, James has won for himself somewhere in the area of $5-10 million, without working one whit harder or longer. When you look at it that way, who wouldn't?

|

|

| Yes, please do! |

|---|

Of course, the people of Cleveland are furious. Unfortunately, instead of outrage at their politicians who would steal so much of James' money, they're angry at James himself.

New Yorkers seem to be a little smarter. The Post put it plainly in an editorial before James' decision was announced:

If LeBron James goes to the Miami Heat instead of the Knicks, blame our dysfunctional lawmakers in Albany, who have saddled top-earning New Yorkers with the highest state and city income taxes in the nation, soon to be 12.85 percent on top of the IRS bite. [emphasis added]

Light Dawns on Marble Head?

Scragged and a host of other commentators have long pointed out what should be transparently obvious: high taxes drive away your wealthiest and most productive citizens. We've written about how Maryland's millionaire surcharge resulted in less cash to their treasury because so many millionaires moved out of state.

So many famous rich people have left New York City, from Tom Golisano to Rush Limbaugh, that it's no longer news. The exodus from California of successful Americans and their replacement by illegal immigrants is legendary. Yet both elected officials and the voters never seem to learn.

Now, though - now that a celebrity sports hero has been lost to his hometown on account of confiscatory taxes - now, just maybe, people will realize that tax rates really do make a difference, really do drive the successful away, and really ought to be reduced or eliminated.

Would the voters of Cleveland have rather had whatever their tax dollars are buying them? Or would they rather have a smaller government and LeBron James playing in the Q Arena?

Fear not! In just a few short months, we'll find out. Election Day in November comes too late for James' lost Cleveland, but it can't come soon enough for countless thousands of less-well-known but more economically-useful entrepreneurs.