Close window | View original article

The Voodoo Magic of Supply-Side Economics

Reagan's numbers really didn't add up - but it worked anyway.

It's being said more and more often that Barack Obama's presidency is Jimmy Carter's second term. Aside from killer rabbits and sweaters, that's mostly true. No matter how much of our money Obama or Carter spent, the economy stayed flatlined; as the federal government drowned deeper in red ink, the only solution proposed by either of them was higher taxes, new government departments, and more regulation.

We recovered from the first Carter administration by putting Ronald Reagan in the Oval Office. Republicans far and wide have long been seeking the Gipper's modern clone; alas, nobody seems to fit the bill.

Can we simply learn from his policies? It's well remembered that Fed Chairman Paul Volcker, with Reagan's strong support, ended dangerous inflation by raising interest rates; but despite many predictions, high inflation is the one problem we don't have, at least not yet.

Reagan's headline economic policy was supply-side economics - the idea that cutting taxes leaves more money in people's pockets. With more money to spend, the theory goes, the more money people will spend. Supply-siders pointed to the increase in government revenue after the Kennedy tax cuts. Today's conservatives trumpet their faith that the Reagan tax cuts did the same thing.

How Not to Win Friends and Influence Rich People

This happy historical combination of lower taxes and increased revenue leads Republicans to propose tax cuts to fix nearly anything that ails the economy. The term "supply side" comes from the notion that if taxes are going down, businesses will have more confidence that they'll get to keep their profits.

Seeing opportunity, they'll invest, which creates more goods to sell, more jobs, and more economic activity, which justifies the investment. If businesses create supply, economic activity will come.

However, there is what appears to be a flaw in the theory: tax cuts only give more money to spend if you're paying taxes in the first place - and nearly half of Americans don't. Democrats love to attack tax cuts as being giveaways to the rich. In a perverse sort of way they're right, because only the rich are paying any taxes to be cut anymore.

Comes the response, "It's the rich that create jobs by making investments and starting companies. Let them keep more of their money, and jobs will be the natural result." Let's hear what a very rich and successful billionaire, Wynn Resorts CEO Steve Wynn, says about that:

There are a host of opportunities for expansion in Las Vegas, a host of opportunities to create tens of thousands of jobs in Las Vegas. I know that I could do 10,000 more myself and according to the Chamber of Commerce and the Visitors Convention Bureau, if we hired 10,000 employees, it would create another 20,000 additional jobs for a grand total of 30,000...

I believe in Las Vegas. I think its best days are ahead of it. But I’m afraid to do anything in the current political environment in the United States.

And I’m saying it bluntly, that this administration is the greatest wet blanket to business, and progress and job creation in my lifetime. [emphasis added]

Our Faith-Based Economy

What's the difference between Reagan and Carter? Just about everything other than race and gender, but aside from their political views, their personal attitudes were as different as night and day.

Carter's message to a struggling American people was, basically, "Get used to it." The most powerful man in the world's answer to the energy crisis was to slap a solar panel on the White House roof, turn down the thermostat, shiver in a sweater, waste billions of dollars creating an ineffective Department of Energy, and let the hostages molder in Iran.

Reagan, in stark contrast, demanded that the hostages be returned "Or else. I know were you live! I'll reach out and touch someone!" He proclaimed Morning in America. He reminded Americans of their country's greatness.

He first gave us hope that it could be like that again. He then convinced us that it would be like that again - and it was.

The Left condemned his plans as "voodoo economics." The numbers don't add up! How can people with no jobs go out and spend?

The numbers didn't add up, to be sure, but the answer lies in what, exactly, Americans were spending: they weren't spending money they had. They were spending their hopes, their expectations, of money they'd have in the future.

The Days of Cash on the Nail

There was a time nearly two centuries ago when Americans spent actual money. When a '49er needed a shovel and gold pan, he went to the store with a bag of gold dust to exchange for it. No gold, no shovel - "In God we trust, all others pay cash." Early Virginia planters may not have had gold, but they had hogsheads of tobacco and whiskey which were just as good.

Either way, to get something they needed, Americans had to exchange something of value they already had. There was no prediction or trust needed: the shovel was here, the tobacco was there, everyone knew they had value. Nobody save government or the new giant railroad corporations ever bought, or needed to buy, something they couldn't pay for on the spot.

That changed in the late 1800s. Cyrus McCormick started letting farmers buy reapers on credit and pay the cost over the next couple of harvests. Sears Roebuck noticed that McCormick's sales went up more than enough to cover the occasional bad loan, so they, too, started offering consumer credit.

By the Roaring 1920s, our system of consumer-durables credit had matured: almost nobody had the cash to buy an automobile or a house all at once. Instead, they borrowed the money from a bank or the manufacturer, paying the debt off over time in an example of capitalism in its purest form.

McCormick, Sears, Ford, and GM all had to have enough capital to cover their manufacturing costs and then wait months, or sometimes years, to be paid in full. This was a new game that only well-funded businesses could play, and even then, they had to get money from banks or from investors to cover their costs in the meantime.

The Future's Not Ours To See - But Wishing Makes It So

Buying on time added an entirely new element to each shopping decision. Not only did what was being purchased have to be more wonderful than the money being paid, the buyer had to ponder financial expectations far off in the unknowable future.

The gold miner hoped he'd find more gold with his new shovel, but there were no future financial expectations required for the purchase: either he had enough gold dust on hand to buy the shovel, or he didn't.

From the 1920s through the 1970s, this was no longer true for consumer durables. The purchase of a house, car, or appliance was a call on future earnings: the buyer expected to have a job for the next five years or however long the loan lasted. If he was confident of keeping his job, he'd buy; if not, he would make do. Minor purchases, though, were still made with cash on hand.

Beginning in the 1980s, even this changed: with the invention of credit cards, you didn't need any cash. You had only to expect to have some by next month's bill, and not even all you'd spent, just the minimum payment. This shifted all spending into the future; vending machines and fast-food joints take plastic now.

Even people who pay their credit cards off every month aren't spending today's money, they're spending next month's money. Credit card companies whack people pretty badly if they're late by even a day; those who pay attention to credit card fees cut back if they see mean times a-comin'. Everybody spends or doesn't spend based on future expectations, not simply today's reality or what's in their wallets at the moment.

Imagining Nightmares Into Life

Switching all spending into the future made everyone's expectations a crucial component of economic activity. Modern Americans spend only so long as they're confident that they'll have a job at least for the next few months.

If they're confident, they'll spend. If they're worried, they'll keep the plastic in the wallet.

That's why cheerleading is such an important part of the President's job. Mr. Carter failed miserably. Instead of cheering us up, he gave his famous "malaise" speech, promising that things would get worse before they got better, and they might not get better at all.

In Mr. Carter's America, people had no reason to expect that they'd have the money they needed next month or next year. They had every expectation that the prices of daily living would be far higher tomorrow than today. Naturally, they stopped buying consumer durables - they had lost faith in their ability to pay off long-term loans.

Without faith in the future, they clung to whatever money they had, and the Carter economy tanked. Reagan the Great Cheerleader gave Americans hope... and that started them spending.

When they went out and bought things with money they did not yet have, their purchases had to exist in the first place and be replaced with new inventory. Factories hired, offices were filled, trucks and trains transported new goods, people got jobs which paid off their loans, and the economy grew as if by magic - which, in a sense, it was. Like Tinkerbell, the economy believed it could fly, so it did.

Depressing Demands

Supply-side economics has become the Republican mantra. Democrats simply don't believe this narrative. They don't believe that letting people keep more money will create more demand and more economic activity.

Instead, they hold the opposite view - demand-side economics - based on the observation that when the economy collapses, normal people don't have any money to spend. The government can always spend money because, unlike you and me, it can create money by fiat or by running the printing presses.

If the government creates money and pumps it into the economy, no matter how, people will have money to spend. Demand-siders, also known as Keynesians, claim that it's government's job to "prime the pump" by putting money into circulation.

Letting people keep more of what they earn doesn't help if they aren't earning anything. Government giveaways give money to everybody who's a friend of the administration.

There's a problem with this scheme: people still spend or don't spend based on their expectations about the future. If people are pessimistic, they'll cling to whatever money they get, whether they earn it or it's given them by the government.

The first time government spending was tried on a massive scale, it didn't work. A full ten years after the 1929 stock market crash and well into Roosevelt's presidency, Treasury Secretary Henry Morgenthau despaired:

We have tried spending money. We are spending more than we have ever spent before and it does not work... After eight years of this administration we have just as much unemployment as when we started... and an enormous debt to boot! [emphasis added]

Why didn't it work? Because government jobs do not create a working economy. Mr. Roosevelt criticized businessmen as much as Mr. Obama has, and he kept creating new government agencies and new rules. Nobody would create productive private sector jobs when they didn't know what the rules were going to be or when they were being called greedy scumballs and worse.

Furthermore, everyone knows that loans must be paid back, whether they're making them or the government is. The money for the trillion-dollar Obama stimulus plan wasn't created out of thin air; it was borrowed from the Chinese, and they expect their money back with interest regardless of the fact that, as Obama himself admitted, the "stimulus" failed miserably.

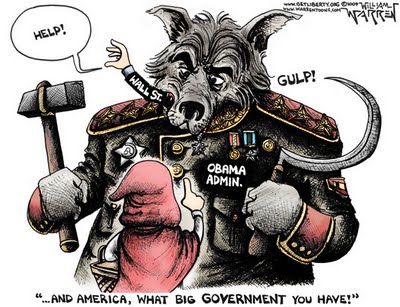

Where's the trillion bucks coming from? President Obama's made it perfectly clear with his insistence on "increased revenues" as part of any deficit-reduction plan - his hand is in your pocket, mine, and everyone else's. Is it any wonder that people from Steve Wynn on down are hanging on to every cent they've got, hiding it, and moving it overseas?

The Obama Malaise

Mr. Obama has created as much malaise as Mr. Carter. He's piled on regulation after regulation. He claims that the banks ought to lend, but bankers are scared - they don't know what the rules are today, much less what they'll be tomorrow.

Suppose they make what would be a perfectly acceptable loan under the old rules. Dodd-Frank may change the rules. All of a sudden, a "good" loan becomes a "bad" loan and they get yelled at.

It's better to sit on the money until the rules settle down which will take years and many court decisions. Mr. Obama has bashed businessmen as badly as Mr. Roosevelt, with exactly the same result. His scary statements have depressed the American people just as much as Carter's.

It's hard to imagine how people feel when the President of the United States keeping calling them evil. I knew a midsize businessman who had a couple of hundred employees during the Depression. He worked extremely had to keep his factory open and take care of his people. There were layoffs and he barely broke even, but he kept many employed.

His reward? To be called bad names for years, as one of the evil rich people who had caused the Depression.

His feelings about Roosevelt were so strong that for the rest of his life, local shopkeepers knew to examine their coins so they wouldn't give him a Roosevelt dime. "I won't have that man's picture in my pocket!" he'd exclaim, and stay away from the store for weeks until he cooled down.

It's Animal Spirits, Not Supply-Side Or Demand-Side

Economists won't acknowledge it for fear of losing their jobs, but supply-side economics and demand-side economics are equally worthless. Mr. Reagan turned the economy around, not by tax cuts per se, but by constant cheerleading. His tax cut helped only because it gave him something concrete to talk about and gave Americans a vaguely rational reason to feel better.

The true Reagan miracle wasn't laws, tax policy, or even regulatory reform. It was that the Great Communicator got Americans to unleash what he called their "animal spirits."

Mr. Deng, the boss of what was then Communist China, accomplished the same thing in an even more effective way: he decided to stop shooting businessmen because people needed jobs. His protégé Hu Yaobank imitated President Reagan by creating the slogan "To get rich is glorious." The Chinese economic boom resulted once businessmen were convinced that it was OK to create jobs and become wealthy thereby.

More now than ever, people spend money based on confidence in the future. Mr. Reagan told us over and over that America was a wonderfully exceptional country and that we'd be wealthy again as soon as we got over the Democrat's mistakes.

Mr. Obama, in contrast, refuses to admit that there's anything exceptional about America other than all the harm it's done over the years, much less that he's made any mistakes worth noting.

Building Confidence

Mr. Reagan told us over and over that he knew we'd do the right thing as soon as he got government out of the way. Mr. Obama doesn't even trust us to decide what kind of food we ought to eat or what kinds of loans we ought to make.

Human beings aren't purely rational Vulcans that deal in numbers, statistics, and economic projections alone. We operate on psychology: the economy won't turn around until enough people believe it will.

The Obama administration shot its credibility by talking about "green shoots" that everyone knows didn't exist, while writing all kinds of laws and regulations which everybody knows kill jobs.

The Reagan boom wasn't caused by his economic polices, although they helped. His prosperity came because he made Americans feel good about themselves.

What about the Clinton boom? He was a lovable rogue who encouraged the nation, but he also got so caught up in scandal that there wasn't time to pass any job-destroying laws.

The Clinton period of "benign neglect" let the economy boom, proving Reagan's point that the American people will do just fine for themselves if government just stays off their backs and stops changing the rules.

It's the economy, stupid - but what the economy needs is cheerleading more than it needs any specific policy. Mr. Obummer is the wettest wet blanket in living memory, casting doom and gloom at every opportunity. No boom for him!