Close window | View original article

Why the FAIR, VAT, or National Sales Tax is a Bad Idea

It feeds the beast.

Every political party has its decades-long policy idols, held up as shining examples of ideological purity and logical consistency but which, somehow, never seem to see the light of day in the real world or among serious people.

On the left, total nuclear disarmament falls into this category: the loony left has wanted it since long before the vast majority of them were born. Powerful leftist leaders like President Obama himself swear fealty to the idea - and yet, somehow, we all realize that there's no way even Mr. Obama would actually decommission our Very Last Nuke. As an idea and theoretical goal, it has great power; as a practical policy, not so much.

There is a similar issue on the right, and that issue is truly fundamental tax reform. This is not to say that our tax system doesn't need some help; anyone who actually attempts to read the tax code will need the services of a forklift.

Examining and overhauling the countless insanities, set-asides, sneaky loopholes, and public-policy biases baked into our tax system is well worth the effort, and over the years there have been several useful and helpful tax reforms. Much as a ship collects barnacles and needs a good scraping-down from time to time, so does the IRS.

Many conservatives want something more profound than mere heavy maintenance; they call for a complete teardown and rebuild in the form of the Fair Tax. The idea of the Fair Tax is transparently simple: get rid of the income tax and have a national sales tax instead.

The scheme is not without a certain appeal. Not only is it a serious pain in the neck for individuals to report their income to the government, it's a serious privacy problem.

Why, exactly, should you have to tell the government how much money you make, and from whom? It's none of their business, really, and having the government know who's got money leads to all manner of tyrannies large and small.

Recently, however, something interesting took place, as the Washington Post reports:

At a White House conference earlier this year on the government's budget problems, a roomful of tax experts pleaded with Treasury Secretary Timothy F. Geithner to consider a VAT... "There is a growing awareness of the need for fundamental tax reform," Sen. Kent Conrad (D-N.D.) said in an interview. "I think a VAT and a high-end income tax have got to be on the table." A VAT is a tax on the transfer of goods and services that ultimately is borne by the consumer.

In economic terms, a VAT is exactly the same as a sales tax, except that unlike the sales taxes we're used to, it's paid by everyone who handles products as they are manufactured. VAT stands for Value-Added Tax, which means that each processor pays tax on the difference between what they paid for their materials and what they sold them for.

Can it be that Obama's crew is in agreement with conservatives? Some commentators appear to think so:

The VAT is probably the ideal tax from a conservative point of view. As a broad-based tax on consumption it creates less economic distortion per dollar of revenue than any other tax--certainly much less than the income tax. If Republicans are successful in defeating a VAT, the alternative will inevitably be significantly higher income taxes, which will do far more damage to the economy than a VAT raising the same revenue.

Here's the problem: the virtue of the VAT, thus explained, is precisely its fatal flaw. A national sales tax, whether it be in the form of a VAT or anything else, is indeed good at hoovering up revenues for the government; it is extremely difficult to evade, and does screw up many fewer activities than the income tax. It's painful only in the pocketbook, not in April 14th migraines and IRS-letter-induced heart attacks.

That's why it's bad - in fact, that's why broad-based taxes of any kind are bad. That's exactly why lovers of big government so badly want one.

Feeding and Starving the Beast

One of the more interesting ways of looking at George W. Bush's economic philosophy, insofar as he had one, was the term "Starving the Beast." As Reagan once said in a political debate:

John Anderson tells us that first we've got to reduce spending before we can reduce taxes. Well, if you've got a kid that's extravagant, you can lecture him all you want to about his extravagance. Or you can cut his allowance and achieve the same end much quicker.

Following this philosophy, Reagan cut taxes and funded his military spending by deficit borrowing; Bush did the same. Bill Clinton, on the other hand, helped by a Republican Congress, cut spending enough to actually reach break-even for the first time in years. The Republican view was that raising taxes is politically painful and cutting them is politically profitable; so, cut taxes, and trust in Democratic opposition to deficits to force them onto your side when it comes to spending cuts.

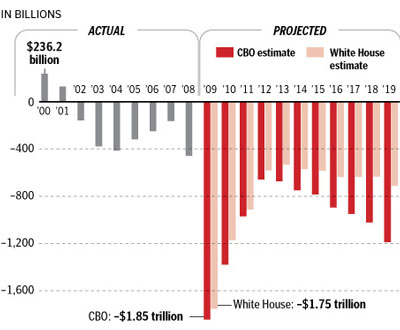

There's only one fallacy with this plan: it makes the assumption that Democrats genuinely dislike deficits, and that getting rid of them is their top priority. As what is fast becoming our favorite graph clearly demonstrates, though, this is totally wrong: Democrats only attack deficits when they're being generated by Republicans.

With President Obama on the throne, he is merrily running up more debt than all our past presidents from George Washington to George W Bush put together. Not only is there nary a squeal, the Democrats are competing to see who can spend the most money. Democrats want nothing more than to spend money: they don't care where it comes from, as long as they are the ones that get to spend it.

No, Mr. Obama's Democrats are following the same underlying idea as Reagan and Bush, but in reverse: instead of starving the beast to make it shrink, they are shooting it full of borrowed steroids in hopes of making it big enough to consume the entire economy before Republicans can recover and stop it.

Thus far, their plan is working excellently; there is every indication that the Chinese are growing tired of loaning us infinite amounts of money in our own easily-debased currency. When they stop, the money to fund the Obama deficit will have to be found somewhere - and that somewhere is your wallet.

Limited Funds, Limited Government

Like most systemic problems of governance, this one was anticipated by our Founders, who designed safeguards into the Constitution. In particular, the federal government was explicitly forbidden to directly tax anything or anybody already within the country, except on a per-head basis. So a head-tax of, say, $10 per person, payable by the states, would be legal; but taxing the revenues of people, companies, or even the states themselves would be unconstitutional because not directly related to hard population numbers.

As a result, for the first century and a half, the federal government got most of its revenues from import tariffs which the Constitution permitted. This was intentional; the Founders wanted to make imports more costly, as an encouragement to domestic industry in what was, at the time, an almost totally rural, undeveloped country.

As the nation grew and industries developed, however, import percentages became less and less, and the federal government found that it couldn't readily lay hands on as much money as it wanted. The call went out for a new source of funds, and the Progressives - today, we'd call them Liberals - answered in 1913 with the 16th Amendment to the Constitution, granting Congress income-taxing power it had not had before.

The 16th Amendment didn't set the level of income tax - it's gone up and down. It didn't specify the rules, either; tax brackets have changed many times, as have all manner of exemptions.

What the amendment accomplished was to permit the federal government to reach its hand into a pot of money totally prohibited to it previously. Before the amendment, Congress could legally take not one dime from income taxes; after the amendment passed, the government was permitted to collect whatever amount the political process could get away with.

Now that is a profound change, and it led to the profound changes we've seen in our country since then. Today, the federal government is involved in areas the Congress of 1912 would have never felt to be its job. Why? Because it can.

Yet even with access to all our incomes, our government is not satisfied. That's because every year, in April, the taxpayers can see the monstrous amount of money they are shelling out, listed at the bottom of our 1040 forms.

Because the money is mostly withheld by our employers, we don't see it and feel it all through they year; it's no accident that Tax Day is almost as far from Election Day as it's possible to get. But it's still there, and we do still see and feel it.

Pains Visible and Invisible

Not so with a sales tax, and particularly not with a VAT. With a sales tax, at least you have the momentary irritation at having to shell out $1.10 for a putatively 99-cent burger. But the amounts involved tend not to be too large.

Even the sales tax on an expensive purchase, like furniture, is going to be a small fraction of your total sales tax bill for the year - though we can't help but notice how many people like to go on annual shopping trips to low-tax states, and how the great and good tried to avoid outlandish New York sales-tax bills on their fine art and jewelry. Nevertheless, 99% of the time a sales tax will bag you without you even noticing.

That makes it easy for the government to crank up the rates - first starting small to get people used to the idea, then slowly notching them up over time. Americans are used to price inflation; everything is more expensive today than ten years ago. Who but economists will know how much is due to the higher taxes?

People won't know why the economy seems sluggish, and their kids are struggling even to be as well off as their parents were at that age - in fact, this problem is already being noted. The American Dream will die by degrees, choked to death, while people wonder why and we turn into a sclerotic European welfare state.

Taxes are, at best, a necessary evil. A small tax is better than a high tax; a visible one is better than an invisible one, because the visible tax can more readily be kept from growing.

The worst possible case is a high, mostly invisible tax. That's exactly what a national sales tax is, whether FAIR, Flat, or VAT - and that's exactly why a president who believes government is the answer to every problem wants one.

Almost certainly, we wouldn't abolish the income tax: we'd wind up paying both, which is exactly what has happened everywhere else the VAT has been tried.

No doubt the conservatives pushing for the FAIR tax have the very best of intentions - but we all know that's what the road to hell is paved with. Any new tax of any kind is, rather, a road that should be stood athwart yelling STOP.

Once a new, previously nonexistent tax is inaugurated, it takes more than a mere act of Congress to get rid of it, but an actual act of God, Who has quite a few other urgent and pressing matters to occupy Him at the moment. Save Him the trouble of divine intervention; let's put the kibosh on this bad idea before it gets out of the idea stage.