It's Not the Deficit, Stupid!

It's the spending.

-

Tools:

The United States Government has run a deficit for so many years that deficit financing has come to be accepted as normal. Except for a couple years at the end of the Clinton administration, America has not managed to pay its bills without borrowing in a half-century; when Strom Thurmond died in 2003, he took with him the last living political memory of serious governmental fiscal responsibility.

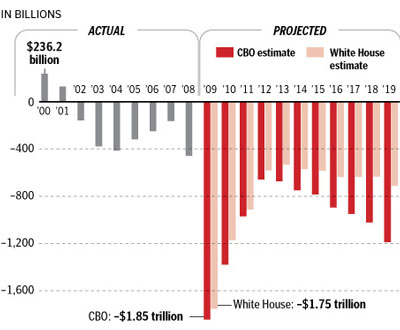

The deficit doesn't seem to have done us much harm in all that time. Still, the astronomical growth of both the deficit and the resulting national debt in recent years is enough to make many people's hair stand on end - and that doesn't even account for the off-the-books liabilities of Social Security, Medicare, Medicaid, or pensions promised to government workers.

If money and economics mean anything sensible and rational, accumulated debt will have to be paid for in some manner by somebody eventually. There are several tested ways to get out of a deficit - blanket default like banana republics do, hyperinflation like Weimar Germany, selective default where we tell the Chinese to go pound sand - but any of these would instantly destroy American credibility, our superpower status, the dollar's status as reserve currency, and our ability to pay for basic social necessities such as the weapons we need to defend our land. These are not prices we really want to pay.

Hence the bottom line: The deficit itself is not the real problem, nor is the debt. The problem is spending.

Spending Our Way Out Of Debt?

Anyone who's ever run a household budget must eventually acknowledge a truth: you cannot spend more than you make forever. You can certainly do it as long as someone is willing to loan you more money. If you started out with valuable assets like a big house you inherited, you may be able to overspend for a long while. Sooner or later, though, you will not be able to borrow any more, and your existing loans will start to come due.

When, exactly, will this take place? It's hard to say. The Chinese have been sending signals for some time that their money is running out - that, even if they wanted to lend us more, they don't have any more to lend. Last week's fun and games around Greece's financial bailout should make it clear that Europe is no more well-heeled than the Chinese.

Who's left? The oil sheiks, who have seen their revenues plummet? Russia, which is trying desperately to return to great-power status and is using every available dime to pay the costs of the upgrade? The Martians?

Of course, when you run into financial trouble, one clear way out is to increase your income. The strapped homeowner hopes to win the lottery or, more practically, seeks a higher-paying job. Our government loves to raise taxes, thinking it will have the same effect.

Unfortunately, it doesn't always - and nowadays, usually doesn't. Maryland discovered this the hard way when they raised taxes on millionaires and many of them moved away, the net result of higher taxes being less cash in the door. When taxes get high enough, people won't bother to work since they won't get to keep much of the money they earn.

How much is too much? The great economist Arthur Laffer developed the Laffer Curve which describes the point where raising taxes is counterproductive. That's why Reagan's tax cuts actually resulted in more money for the government.

Since Laffer's time, other researchers have put a great deal of effort into calculating the optimal tax rate. It turns out that we're not actually on the far side of the Laffer curve at the moment; it would be possible for tax rates to go up significantly and government revenues to do likewise, if it were artfully done.

Problem solved, right? Nope. According to the calculations, even if taxes were set at the precise points optimized to raise the maximum amount of revenues, that much money - large as it is - is still not enough to cover our debts.

If our ruthless federal revenue-maximizers went all-out in raising taxes, they could raise maybe 24% of GDP. That is not quite salvation when the federal government is spending over 24% of GDP right now!

Reality and the Avoidance Thereof

So let's review:

We cannot borrow enough money to pay for all Obama's plans.

The Chinese have run out of money to loan us even if they wanted to.

We cannot raise taxes enough to pay for all Obama's plans because the maximum possible revenues are still lower than projected spending.

That means we must cut. Not slow the growth; not reduce raises; not seek out the ever-ephemeral "waste, fraud, and abuse." But cut, in the sense of shutting down entire departments and laying off bureaucrats en masse.

What if we don't? Well, there eventually comes a time when the lights go out and the water turns off because you have not paid your bill. Is that really what we want our government to come to?

The deficit is a problem, yes, but it's not the problem. It's only a symptom.

We've been treating the symptom for fifty years while rarely if ever paying attention to the underlying disease - that cancer of government spending which, if left unchecked, will destroy our wealth, nation, and freedoms, just as Confucius predicted 2,500 years ago.

-

Tools:

What does Chinese history have to teach America that Mr. Trump's cabinet doesn't know?

The only solution is the one proposed: Significant cuts in spending. This includes dealing with the "non-discretionary" spending: Social Security, Medicare and Medicaid, government pensions. These are the source of over half our spending problem. Not only that, but they're also unconstitutional spending (not the pensions directly, but indirectly as the result of having a department doing things that aren't constitutional).

It's like cancer. We can either go in and excise the tumor, or we dabble with different treatments pretending to shrink it. It's time for serious cuts, not chemo.

Well said. We need to trim the fat off the government and we need to do it without mercy. And, as with any diet, we need to make sure we KEEP it off.