National Debt: The First Shoe Drops

First Europe; eventually, America.

-

Tools:

Back in the day when city people lived in ill-constructed tenement apartments, you could always tell when your upstairs neighbor was getting ready for bed. First, they'd creak across the ceiling of your bedroom over to the bed. Then, you'd hear the first shoe go "clunk" against the floor as they kicked it off and let it fall. It was futile to try to go to sleep before you heard the second shoe drop because that second "clunk" would wake you up again. Hence, the downstairs-dweller would be stuck waiting for the other shoe to drop, unable to relax and go back to sleep.

For many years, those of us who are able to add up total government debt and subtract national income as taxpayers lose their jobs to globalization or to the Obama depression have been warning that our nation is on a spending path that simply can't go on forever. Twenty years ago, we were laughed at - "Of course, we'll pay everybody's Social Security - it's required by law!" As more and more people began to catch on to the reality of the coming fiscal train wreck, we were accused of meanness for wanting to slash all those hard-earned government pensions and health benefits.

The First Shoe

At long last, the New York Times is writing about the coming financial crisis. They've dropped the first shoe, and not before time.

The teaser for their lead story of May 23, 2010 was, "The deficit crisis that threatens the euro along with an aging population and low growth has undermined the sustainability of Europe's standard of social welfare."

This sentence, while perfectly true, ranks up with Japanese Emperor Hirohito's observation following the nuking of Hiroshima and Nagasaki that "the war in the Pacific has proceeded not necessarily to our complete advantage." Talk about an understatement! We'd say "annihilated" rather than "undermined" or the Emperor's more convoluted expression.

As with Hirohito's remark, however, at least the Times is taking an essential step in the direction of reality. The article titled "Payback Time - Europeans Fear Crisis Threatens Liberal Benefits," says:

Europeans have benefited from low military spending, protected by NATO and the American nuclear umbrella. They have also translated higher taxes into a cradle-to-grave safety net. "The Europe that protects" is a slogan of the European Union.

Americans have known for a long time that our defense spending has made it possible for Europe to get a free ride, but even that subsidy is not enough to preserve the European welfare system.

With low growth, low birthrates and longer life expectancies, Europe can no longer afford its comfortable lifestyle, at least not without a period of austerity and significant changes. The countries are trying to reassure investors by cutting salaries, raising legal retirement ages, increasing work hours and reducing health benefits and pensions. [emphasis added]

Anybody who thinks about the situation for very long realizes that no government can spend more money than it collects in taxes forever - something has to give when lenders won't lend any more. As Margaret Thatcher put it, "Eventually you run out of other people's money."

The reaction so far to government efforts to cut spending has been pessimism and anger, with an understanding that the current system is unsustainable [emphasis added]

Much as we'd like to believe that Europeans understand that their system can't go on, the riots in Greece and the union-driven protests in France suggest that most people who benefit from the current system are in no mood to consider cutting their benefits. Although polls say that a majority of French citizens agree that the current pension system must be changed, they oppose cutting benefits or raising the retirement age. If you can't impose either of those fixes, what can you do?

|

|

| The coming train-wreck |

|---|

Here's the Rub

There are two fundamental problems:

People are living longer than they used to - instead of collecting for 3 or 4 years, retirees collect for 30 or 40 years.

Today's retirees had too few children to sustain the system.

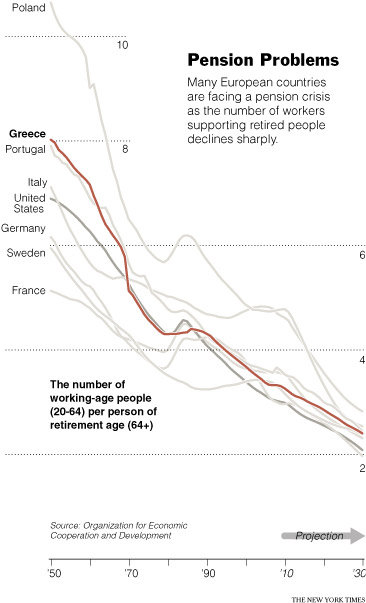

The graph makes the coming crisis all too clear - it would take a 25% pension-tax rate for two workers just to support one retiree at 50% of final pay, and that simply can't happen. Even if it could, many public-sector pensions pay more than the employee earned while working. That would require a 50% tax on two workers just for pension purposes - plus whatever else government wanted to spend on everything else. When something simply can't go on, it won't.

Will They Drop The Second Shoe?

The Times' article describes the situation in Europe, of course. They're not yet ready to point out that American finances are in equally bad shape. Mixed in with all the articles about the Greek overspending crisis, we've seen many which claim that America is not Greece and that our deficits are far more manageable. These articles generally claim that we're in good shape because the American deficit is about half of annual GNP whereas Greek debt is more than their annual GNP.

This lie omits the awkward fact that, assuming that we actually intend to honor our commitments to retirees and the newly-insured who expect to benefit from Obamacare, our total future obligations far exceed our annual GNP. We don't know how much bigger Greece's debts are than have been publicly disclosed - politicians love to lie about what they've promised to spend in the future - but the hidden obligations we've taken on put us in worse shape than Greece.

The Wall Street Journal points out that the Taxed Enough Already (TEA) party and the government employee unions are the two biggest players in the coming November elections. Even though public sector pay is about 30% greater than comparable jobs in the private sector, our government unions aren't any more eager to see their pensions and benefits cut than the Greek or French unions who're leading the riots.

On the other hand, the Tea Party people have seen our current government-inspired depression annihilate their retirement investments. They don't like seeing their retirement benefits disappear any more than unions enjoy pension cuts and they aren't eager to pay for the pensions and benefits the politicians promised the unions. The tea parties seem to have been triggered by the prospect of paying for Obamacare while watching their own health care fall apart, but they're also beginning to see that the other government entitlements are equally unaffordable.

Although the New York Times includes labor unions when complaining about "special interests" who control Albany and keep spending high, they haven't written much about the looming liabilities we're facing with respect to public pensions that were negotiated in the past. California, New Jersey, Michigan, Illinois, and New York are facing debt-to-income problems which are comparable to the numbers which triggered the Greek crisis.

The rest of Europe created a trillion-dollar fund to help bail out the free-spending Greeks, Portuguese, Spanish, and Italians. A major portion of Mr. Obama's trillion-dollar stimulus went to state governments so they wouldn't have to cut government employee pay, but that's not likely to happen again.

Will the Second Shoe Fall?

The outline of the coming train wreck has been obvious for many years. The Times has dropped the first shoe in pointing out the magnitude of the coming European disaster. Will they drop the second shoe and explain that America faces the same problem? Or are they afraid that if the Tea Party folks understood the full magnitude of the coming government-inspired disaster that they'd vote all the rascals out?

-

Tools:

What does Chinese history have to teach America that Mr. Trump's cabinet doesn't know?

For our part, stop demanding government fix your personal problems.

I'm afraid Obama just something else stupid, taking responsilbilty for the oil spill.

Faye

Easy Money, Hard Truths

By DAVID EINHORN

Is the U.S. doing enough to keep debt from spiraling out of control? The signs are not encouraging.

http://www.nytimes.com/2010/05/27/opinion/27einhorn.html

Before this recession it appeared that absent action, the government's long-term commitments would become a problem in a few decades. I believe the government response to the recession has created budgetary stress sufficient to bring about the crisis much sooner. Our generation - not our grandchildren's - will have to deal with the consequences.

And then there's this one about New York:

Budget Problems in New York and Mr. Cuomo

Andrew Cuomo, set to accept the Democratic nod for

governor, has some interesting long-range plans, but he needs to explain how to fix the budget crisis. And now.

http://www.nytimes.com/2010/05/27/opinion/27thu4.html

Mr. Cuomo correctly points out that the health care and education systems in New York are among the costliest in the nation. Some of his proposals to organize and pare these costs make sense - including a complete state takeover of the administration of Medicaid from counties. That could not happen quickly enough to help with this year's budget problems. Nor will his proposal to streamline an overlapping, multilayered bureaucracy.

His more immediate budget solutions, which include a salary freeze for state workers, are clearly meant to appeal to Republican voters. Mr. Cuomo also wants no new taxes, no more borrowing and caps on property taxes and spending. We are eager to hear the details of how that balances the budget.

http://online.wsj.com/article_email/SB10001424052748704764404575286451653109876-lMyQjAxMTAwMDAwNTEwNDUyWj.html

The increasing size of the federal work force is an early indication of what lies ahead. The Bureau of Labor Statistics reports that in the last year the federal government added 86,000 permanent (non-Census) jobs to the rolls. And high-paying jobs at that: The number of federal salaries over $100,000 per year has increased by nearly 50% since the beginning of the recession.

Today, the average federal worker earns 77% more than the average private-sector worker, according to a USA Today analysis of data from the federal Office of Personnel Management. To pay for bigger government, the private sector will bear a heavier tax burden far into the future, suppressing the innovation and entrepreneurship that creates growth and real opportunity, not to mention the revenue that pays for everything else in the first place.

If these trends are not reversed, it is hard to see how our culture of free enterprise will not change. More and more Americans, especially younger Americans, will grow accustomed to a system in which the government pays better wages, offers the best job protection, allows the earliest retirement, and guarantees the most lavish pensions. Against such competition, more and more young, would-be entrepreneurs will inevitably choose the safety and comfort of government employment-and do so with all the drive that is generally thought to be "good enough" for that kind of work.

What will happen as our increasing number of state employees confront a shrinking private-sector tax base? Just look to the streets of Athens.

Prune and Grow

By DAVID BROOKS

It's time to consider whether cutting rather than increasing spending might be the real path to economic recovery.

http://www.nytimes.com/2010/06/11/opinion/11brooks.html

PAYBACK TIME

Labor's New Critics: Old Allies in Elected Office

By STEVEN GREENHOUSE

Republicans have often railed against public employees' pay and benefits, but now friends of labor are joining in.

http://www.nytimes.com/2010/06/28/business/28union.html?th&emc=th

NYT says the rest of Europe is beginning to catch on:

Europe Fears That Debt Crisis Is Ready to Spread

European officials are concerned that a crisis like the one that hit Greece this year could spread to Ireland and Portugal.

http://www.nytimes.com/2010/11/16/business/global/16euro.html?nl=todaysheadlines&emc=a2

LONDON — European officials, increasingly concerned that the Continent’s debt crisis will spread, are warning that any new rescue plans may need to cover Portugal as well as Ireland to contain the problem they tried to resolve six months ago.

Any such plan would have to be preceded by a formal request for assistance from each country before it would be put in place. And for months now, Ireland has insisted that it has enough funds to keep it going until spring. Portugal says it, too, needs no help and emphasizes that it is in a stronger position than Ireland.

While some important details are different, the current situation feels eerily similar to what happened months ago in Greece, where the cost of borrowing rose precipitously.

European authorities stepped in with a rescue package, expecting an economic recovery and the creation of new European rescue funds to fend off future panics by bond investors whose money is needed by countries to refinance their debt.

But with economic conditions weakening, markets are once again in turmoil. Rescuing Ireland may no longer be enough.

Stronger countries and weaker countries using the common currency of the euro are being pulled in different directions.

Some economists wonder if unity will hold or if some new system that allows countries to move on one of two parallel financial tracks is needed.

Despite the insistence of Irish officials that only its banks need additional help, investors continue to bet on an Irish rescue, driving down the bond yields on that country’s debt against a benchmark again on Monday.

Portugal’s yields increased to 6.7 percent, underscoring the emerging concern in Brussels, the administrative center of the European Union, that it would be irresponsible to adopt a plan to prop up Ireland without addressing the possibility that turmoil could ultimately engulf Portugal, or even Spain. Like Ireland, Portugal has struggled to grow under the fixed currency regime of the euro. Though Portugal has raised enough funds of late from bond markets, its budget deficit is 9 percent of its gross domestic product, much higher than the 3 percent limit for countries in the euro zone. With its weak government and slow growth, investors have grown fearful that Portugal, too, will eventually run out of funds.

While Ireland has largely impressed European officials with its commitment to austerity, Portugal has been lagging in this regard, according to European officials. One official in Europe, who asked for anonymity because he was not authorized to speak publicly, said that the budget recently presented by the government in Lisbon did not contain the type of far-reaching changes proposed by other countries, like Spain.

“If Ireland were to ask for aid, then you’d have to look at what’s going on in Portugal as well,” the official said, putting forward a view rescuing Ireland alone would not keep speculators from other vulnerable countries.

José Manuel Barroso, president of the European Commission, said on Monday that Ireland had not requested aid. “We have all the instruments to address the problems that may come either in the euro area or outside the euro area,” he told reporters in Brussels.

The Portuguese finance minister, Fernando Teixeira dos Santos, said Monday evening in Brussels that the situation in Ireland was creating dangers for all countries using the euro.

Now the Times thinks that the situation in some states is really bad. m They think the feds will have to bail out the states, but admit that this will be difficult given the current political climate. Last year, the feds paid ONE THIRD of state budgets! This has gotta stop!

Mounting State Debts Stoke Fears of a Looming Crisis

The budget imbalances and debt in states and localities remind some analysts of the run-up to the subprime mortgage meltdown, or of the crisis hitting Europe.

http://www.nytimes.com/2010/12/05/us/politics/05states.html?nl=todaysheadlines&emc=a2

The State of Illinois is still paying off billions in bills that it got from schools and social service providers last year. Arizona recently stopped paying for certain organ transplants for people in its Medicaid program. States are releasing prisoners early, more to cut expenses than to reward good behavior. And in Newark, the city laid off 13 percent of its police officers last week.

While next year could be even worse, there are bigger, longer-term risks, financial analysts say. Their fear is that even when the economy recovers, the shortfalls will not disappear, because many state and local governments have so much debt — several trillion dollars’ worth, with much of it off the books and largely hidden from view — that it could overwhelm them in the next few years.

“It seems to me that crying wolf is probably a good thing to do at this point,” said Felix Rohatyn, the financier who helped save New York City from bankruptcy in the 1970s.

Some of the same people who warned of the looming subprime crisis two years ago are ringing alarm bells again. Their message: Not just small towns or dying Rust Belt cities, but also large states like Illinois and California are increasingly at risk.

Municipal bankruptcies or defaults have been extremely rare — no state has defaulted since the Great Depression, and only a handful of cities have declared bankruptcy or are considering doing so.

But the finances of some state and local governments are so distressed that some analysts say they are reminded of the run-up to the subprime mortgage meltdown or of the debt crisis hitting nations in Europe.

Analysts fear that at some point — no one knows when — investors could balk at lending to the weakest states, setting off a crisis that could spread to the stronger ones, much as the turmoil in Europe has spread from country to country.

Mr. Rohatyn warned that while municipal bankruptcies were rare, they appeared increasingly possible. And the imbalances are so large in some places that the federal government will probably have to step in at some point, he said, even if that seems unlikely in the current political climate.

“I don’t like to play the scared rabbit, but I just don’t see where the end of this is,” he added.

Resorting to Fiscal Tricks

As the downturn has ground on, some of the worst-hit cities and states have resorted to fiscal sleight of hand to stay afloat, helping them close yawning budget gaps each year, but often at great future cost.

Few workers with neglected 401(k) retirement accounts would risk taking out second mortgages to invest in stocks, gambling that the investment gains would be enough to build bigger nest eggs and repay the loans.

But that is just what Illinois, which has been failing to make the required annual payments to its pension funds for years, is doing. It borrowed $10 billion in 2003 and used the money to invest in its pension funds. The recession sent their investment returns below their target, but the state must repay the bonds, with interest. The solution? Illinois sold an additional $3.5 billion worth of pension bonds this year and is planning to borrow $3.7 billion more for its pension funds.

Times says young Europeans are getting frustrated over no job prospects, and the pension system is going broke.

Europe's Young Grow Agitated Over Future Prospects

Experts warn of volatility in state finances and the broader society as the most highly educated generation in the history of the Mediterranean hits one of its worst job markets.

http://www.nytimes.com/2011/01/02/world/europe/02youth.html?nl=todaysheadlines&emc=tha22

LECCE, Italy — Francesca Esposito, 29 and exquisitely educated, helped win millions of euros in false disability and other lawsuits for her employer, a major Italian state agency. But one day last fall she quit, fed up with how surreal and ultimately sad it is to be young in Italy today.

It galled her that even with her competence and fluency in five languages, it was nearly impossible to land a paying job. Working as an unpaid trainee lawyer was bad enough, she thought, but doing it at Italy’s social security administration seemed too much. She not only worked for free on behalf of the nation’s elderly, who have generally crowded out the young for jobs, but her efforts there did not even apply to her own pension.

“It was absurd,” said Ms. Esposito, a strong-willed woman with a healthy sense of outrage.

The outrage of the young has erupted, sometimes violently, on the streets of Greece and Italy in recent weeks, as students and more radical anarchists protest not only specific austerity measures in flattened economies but a rising reality in Southern Europe: People like Ms. Esposito feel increasingly shut out of their own futures. Experts warn of volatility in state finances and the broader society as the most highly educated generation in the history of the Mediterranean hits one of its worst job markets.

Politicians are slowly beginning to take notice. Italy’s president, Giorgio Napolitano, devoted his year-end message on Friday to “the pervasive malaise among young people,” weeks after protests against budget cuts to the university system brought the issue to the fore.

Giuliano Amato, an economist and former Italian prime minister, was even more blunt. “By now, only a few people refuse to understand that youth protests aren’t a protest against the university reform, but against a general situation in which the older generations have eaten the future of the younger ones,” he recently told Corriere della Sera, Italy’s largest newspaper.

The daughter of a fireman and a high school teacher, Ms. Esposito was the first in her family to graduate from college and the first to study foreign languages. She has an Italian law degree and a master’s from Germany and was an intern at the European Court of Justice in Luxembourg. It has not helped.

“I have every possible certificate,” Ms. Esposito said dryly. “I have everything except a death certificate.”

Even before the economic crisis hit, Southern Europe was not an easy place to forge a career. Low growth and a corrosive lack of meritocracy have long posed challenges to finding a job in Italy, Greece, Spain and Portugal. Today, with the added sting of austerity, more people are left fighting over fewer opportunities. It is a zero-sum game that inevitably pits younger workers struggling to enter the labor market against older ones already occupying precious slots.

As a result, a deep malaise has set in among young people. Some take to the streets in protest; others emigrate to Northern Europe or beyond in an epic brain drain of college graduates. But many more suffer in silence, living in their childhood bedrooms well into adulthood because they cannot afford to move out.

“They call us the lost generation,” said Coral Herrera Gómez, 33, who has a Ph.D. in humanities but still lives with her parents in Madrid because she cannot find steady work. “I’m not young,” she added over coffee recently, “but I’m not an adult with a job, either.”

NY Times now admits that Greek government regulations stifle business:

What's Broken in Greece? Ask an Entrepreneur

As one microbrewer sees it, outdated government rules have helped make many Greek companies uncompetitive.

http://www.nytimes.com/2011/01/30/business/30greek.html

DEMETRI POLITOPOULOS says he has suffered countless indignities in his 12-year battle to build a microbrewery and wrest a sliver of the Greek beer market from the Dutch colossus, Heineken.

His tires have been slashed and his products vandalized by unknown parties, he says, and his brewery has received threatening phone calls. And he says he has had to endure regular taunts — you left Manhattan to start up a beer factory in northern Greece? — not to mention the pain of losing 5.3 million euros.

Bad as all that has been, nothing prepared him for this reality: He would be breaking the law if he tried to fulfill his latest — and, he thinks, greatest — entrepreneurial dream. It is to have his brewery produce and export bottles of a Snapple-like beverage made from herbal tea, which he is cultivating in the mountains that surround this lush pocket of the country.

An obscure edict requires that brewers in Greece produce beer — and nothing else. Mr. Politopoulos has spent the better part of the last year trying fruitlessly to persuade the Greek government to strike it. “It’s probably a law that goes back to King Otto,” said Mr. Politopoulos with a grim chuckle, referring to the Bavarian-born king of Greece who introduced beer to the country around 1850.

Sitting in his office, Mr. Politopoulos took a long pull from a glass of his premium Vergina wheat beer and said it was absurd that he had to lobby Greek politicians to repeal a 19th-century law so that he could deliver the exports that Greece urgently needed. And, he said, his predicament was even worse than that: it was emblematic of the web of restrictions, monopolies and other distortions that have made many Greek companies uncompetitive, and pushed the country close to bankruptcy.

“Why do you think no one is willing to invest in Greece?“ he asked. Greek leaders say they welcome business, he said, adding: “Yes, they are trying — but they have to back it up.”

For decades, Greece has been a wonderful place to be a lawyer, a pharmacist, an architect, a university president or even a truck driver— all occupations protected by an array of laws that have shielded them from local and foreign competitors. Greek pharmacists are guaranteed a minimum profit on their sales and charge some of the highest prices in Europe. And because they have fixed minimum fees, the 40,000 or so lawyers in Greece receive more for their time than their peers in many other European countries.

It has been very profitable to be a brewer in Greece, too — if you control 72 percent of the beer market, as Heineken now does.

The Greek economy is riddled with distortions — the number of trucking licenses has remained unchanged in Greece since 1971, for example, and the country is among the world’s leaders in lawyers per capita. It has one lawyer for every 250 people, compared with about one for 272 in the United States.

The effect on Greek competitiveness could not be more pernicious.

NYT reports that Greece needs another bail out. They say:

A Greek rescheduling could set a worrisome precedent. But no serious banker any longer believes Greece can pay all that it owes on time. Greece got itself into this mess. But Europe will have to help it get out. It will become even harder the longer Europe waits and pretends.

WHY should Europe help? The Times admits Greece did this by itself; why should the taxpayers of the rest of Europe bail Greece out?

One Year and Many Billions Later

Greece needs more help from Europe - and a smarter bailout this time.

http://www.nytimes.com/2011/05/14/opinion/14sat2.html?nl=todaysheadlines&emc=tha211