Socialist Sen. Sanders Has a Point

Yes, we do urgently need to break up "too big to fail" banks.

-

Tools:

As we noted yesterday, the Occupy Wall Street protestors have the germ of a point: our current political and financial overlords are totally corrupt, exchanging money and favors without regard to the national interest, the greater good, or the Constitution. Alas, their "solution" to this very real problem is the death of liberty and free speech brought about by public financing of elections and restrictions on who is allowed to speak.

Perhaps they should lend an ear to Sen. Bernie Sanders, the one guy in Congress who won't be insulted if you call him a socialist - "Socialist" is, in fact, the party he has registered, run, and won elections under for lo these many years!

Like the OWS gang's posting, Sen. Sanders' recent list of "Six Demands to Make of Wall Street" is filled with lunatic schemes long beloved of the international far left. Unlike them, however, a couple of his points are not only well worth pondering, they would go some way towards being helpful solutions. Will wonders never cease?

As with Rep. Kucinich, let's throw out the chaff and look at the good ideas regardless of their questionable source.

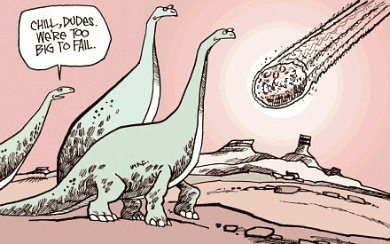

Too Big To Succeed

In his very first suggestion, Sen Sanders says:

If a financial institution is too big to fail, it is too big to exist. Today, the six largest financial institutions have assets equal to more than 60 percent of GDP. The four largest banks in this country issue two-thirds of all credit cards, half of all mortgages, and hold nearly 40 percent of all bank deposits. Incredibly, after we bailed out these big banks because they were "too big to fail," three out of the four largest are now even bigger than they were before the financial crisis began. It is time to take a page from Teddy Roosevelt and break up these behemoths so that their failure will no longer lead to economic catastrophe and to create competition in our financial system.

There is not one single thing wrong with this statement. In fact, not only do we agree wholeheartedly with Socialist Sen. Sanders, we wrote precisely the same thing nearly three years ago. Has the Senator been trawling in our backfiles?

The point is as true today as it was then: If a company is so immensely large and powerful that its failure has the realistic potential to collapse our entire economy, its very existence is a clear and present danger to the security of the United States.

One hundred years ago, Teddy Roosevelt battled the giant monopoly "trusts" that controlled railroads, steel, and other commodities. He didn't do this to redistribute their wealth: the trusts were bad because they prevented proper competition, and thus dictated unreasonably high prices for ordinary Americans.

In recent years, our government seems to have forgotten its right and proper role of enforcing fair and thorough competition. How can it be just for any company to receive a government bailout? It ought instead to go out of business and other nimbler competitors to take over.

In 2008, our leaders didn't dare let any more big banks collapse after the shock of Lehman's demise wreaked havoc on the global financial system - so instead they bailed everything out. The only way this could have been necessary is because government had totally abdicated its authority over fair competition.

Why were Citibank and Bank of America permitted to grow so enormous? Now, after a frightening object lesson in the danger of over-massive banks, why on Earth have both banks been permitted to get even bigger than they were before? Like planting trees, the best time to break them up was ten years ago; the second-best time is today.

Crony One-Worlder Capitalism

The Senator has another well-justified complaint:

The Federal Reserve needs to provide small businesses in America with the same low-interest loans it gave to foreign banks. During the financial crisis, the Federal Reserve provided hundreds of billions of dollars to foreign banks and corporations including the Arab Banking Corporation, Toyota, Mitsubishi, the Korea Development Bank, and the state-owned Bank of Bavaria. At a time when small businesses can't get the lending they need, it is time for the Fed to create millions of American jobs by providing low-interest loans directly to small businesses.

It is bad enough for the U.S. government to use taxpayer dollars to bail out American banks. It is immeasurably worse for the U.S. government to use taxpayer dollars to bail out foreign banks and other firms. If Toyota needs help, don't they know any sticky-fingered politicians in Tokyo? What possible reason could there be for our money to go to a bank that's owned by a government in Germany?

It's awful that we must be Uncle Sugar to our own failures both corporate and individual; it's preposterous for us to be Uncle Sugar to the entire world. Go ask the Chinese to lend a hand, if you must; they've got everyone's money now anyway.

So Sen. Sanders is quite right that, if our government must loan cheap money to Arab bigshots, the least it can do is offer the same terms to American small businesses and entrepreneurs.

The problems with this plan are instantly obvious, as the current Solyndra scandal makes plain - which just goes to show that Sen. Sanders has the wrong solution. Instead of loaning money to everybody, the government should loan money to nobody.

In fact, the government should give money to nobody except for services rendered and goods purchased. If we stopped shoveling our hard-earned dollars down ratholes, maybe we'd have more of them when they're needed.

Let's hope Sen. Sanders submits bills to address his "demands" individually. We'd gladly support at least two of them.

-

Tools:

What does Chinese history have to teach America that Mr. Trump's cabinet doesn't know?

I didn't ever think that I'd agree with Bernie Sanders on anything, but like this writer I agree with these two proposals. I also agree that the government should not be loaning money to ANYONE, especially non-citizens, non-American companies.

There should be NO business, banking or otherwise, that's "too big to fail". If they are failing there are means to handle such failures, legal means that don't cost the taxpayers now and for decades or centuries to come everything they've worked for.

Your first sentence says it all.

There is no business too big to fail and there should be no need to break up any company because it is too big. I cite the egregious example of the government breaking up Standard Oil. John D. Rockefeller drove down the price of kerosene from 26 cents per gallon to less than six cents per gallon while he was building his "monopoly". The government enters the picture, breaks up the company into five different companies and voilá, prices of kerosene rise costing people millions of dollars. The companies that were in competition with Standard Oil had friends in high places. There is absolutely no reason to break up a company. It will implode all by itself if it does not remain relevant to its customers. I ask, who would have thought fifty years ago that Sears would be on the edge of bankruptcy? WalMart came along with a better idea and blew Sears out of the water. The same thing will happen to WalMart. It is the capitalistic system if we will just let it work. The way to insure this is for government to not get involved in crony capitalism.

As for lending money to overseas companies my only comment is this. We, the people, are idiots if we re-elect these rock stars to congress again. Just how in the world they can even consider doing that is beyond me except for the fact that there is probably money involved for our rock stars.

"The Federal Reserve needs to provide small businesses in America with the same low-interest loans it gave to foreign banks."

No way -- don't swallow the liberal lie. The Fed shouldn't be giving those loans to anyone!