Phoney Baloney Financing

The "good old days" were based on economic lies.

-

Tools:

Donald Trump's catchy slogan "Make America Great Again" strikes a resounding chord with the vast majority of Americans who see quite clearly that our power, wealth, and security are a shadow of what they once were.

No amount of statistical manipulation can persuade Americans that they are just as well off as their parents or grandparents were in 1960, because in concrete terms, they aren't. Sure we have gadgets undreamed-of in the age of the Beatles, but back then there were pensions, lifetime jobs, middle-class incomes for high-school graduates, and basically, a living job for anyone willing to work.

Today, the ax can fall on any of us at any time with no guarantee of finding a replacement job anytime soon. If that's not a decline in living standards, what is?

It would be different if jobs paid a lot more than they did back then, but they don't:. Adjusted for inflation, wages have been basically flat for half a century.

Lots of people from politicians to pundits put forward explanations as to why we were doing so well then and not since. For instance, back then there was no competition from closed China or India, incompetent Russia, smashed-flat Europe and Japan, or the starving Third World. Or maybe we were a more religious and moral people who worked harder. Or perhaps we were unified in a way we aren't today which made everything more efficient.

The list goes on and on, mostly of things which we couldn't readily change even if we wanted to. We might possibly be able to do something about the wage-depressing influence of illegal immigrants, or the dire competition-free stupor of our public-school system, but effective solutions would require more political will than we seem to be able to muster.

There is, however, another point of view; that the "good old days" weren't so good after all, or rather, they only seemed good because they were phoney.

Living A Lie

Imagine a family where the breadwinner has a decent-paying job. They are not welfare scroungers; they aren't trust-fund kids; they aren't drug dealers. They aren't even dishwashers.

No, the father has a proper middle-class job with a living salary and benefits, and the wife works as has become the norm. Their income isn't enormous but neither is it minuscule. They are, in short, average Americans.

Yet, each and every month, they spend $1,000 more than they earn.

Does this mean they are driving Ferraris? Of course not; nothing that extreme. It's simply that their lifestyle is just a little bit more lavish than it would be if they lived within their means.

How is this possible? There's the obvious: every American is bombarded with credit cards, and if you pay the minimum diligently, you can keep an excellent credit rating while still spending much more than you receive. There are other possibilities too: maybe their house increased in paper value and they took out a second mortgage.

Regardless, the fact remains, they spend more than they earn. How much of their life is, therefore, a lie? Not all of it - they do work, they do earn money - but some of their consumption is based on a lie about their income.

You might think that eventually it will all come crashing down, and indeed, it might. Then again, it might not, and again we can imagine any number of ways they may get out of the trap. They might win Powerball; someone might suddenly get a big promotion; a rich uncle might die and leave them a legacy. Maybe one of them will die in awkward fashion, leaving a large insurance settlement to the survivors.

All these things are possible; indeed, they happen every day. Only a fool would count on one of them happening to them personally, but in the meantime, they're living a decent life and nobody knows the real truth, possibly not even they themselves.

That is exactly what boom-time America was, in the 1960s and 1980s: an era of phoney wealth. Why phoney? Because, as a nation, we were mortgaging ourselves to the hilt.

The Legacy of Debt

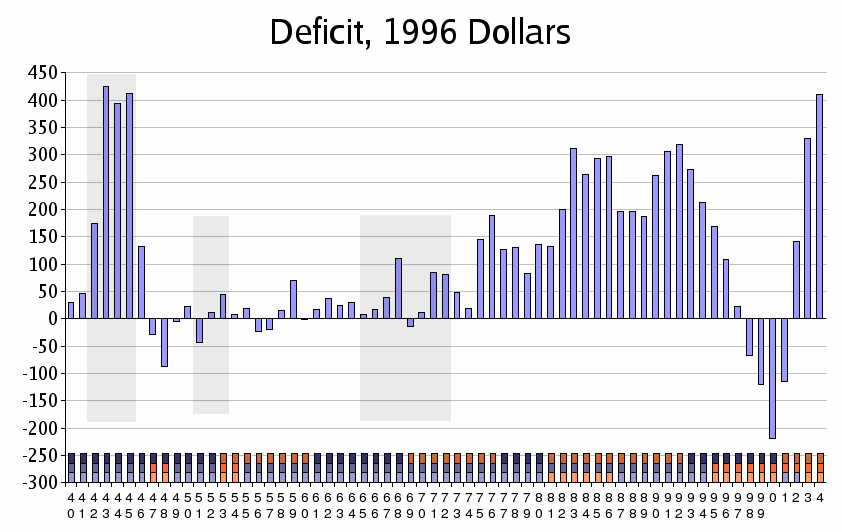

We are all familiar with the ever-increasing graph showing America's national debt, but here is a different chart you may not have seen: one showing the annual deficit, that is, the amount our government spends over what it receives each year.

What's more, the amounts are adjusted for inflation. Normally, the dollar gets worth less every year, so no matter what you are showing, the amounts get bigger as you move to the right. On this chart, a "dollar" in 1940 is the same in value as a dollar in 1990.

It's no surprise that there were huge deficits in the 1940s - we were fighting a world war. You might compare that to a family's finances when their house burns down: they're going to be spending a whole lot more than normal for some time to come, as they recover from that disaster. It's not a permanent situation, merely a temporary emergency.

Sure enough, spending got under control pretty quickly after the war. Indeed, in 1947, 1948 and 1949, the government ran a surplus. 1950 had a deficit, but that was at the beginning of the Korean War, and in 1951 the surplus was much larger.

Then something seemed to change. From 1952 through 1969, there were surpluses only four times, and the deficits were far larger than the surpluses had been. From 1969 until 1998, there were no surpluses whatsoever.

During the Gingrich years, America not only had surpluses, they were larger than at any time in the previous half-century if not longer. Since then it's been all downhill, and this chart doesn't even show the record-setting Obama deficits.

Many conservatives believe that government deficit spending is the cause of our economic woes; many liberals, most notoriously Paul Krugman, believe deficit spending is the cure for all recessions. Yet if we compare this chart to the economic cycle, there doesn't seem to be a correlation at all.

In the late 1940s, when the government was paying down war debts, the country experienced a recession. In the 50s and 60s the trend was to larger deficits and the economy boomed. In the 1970s, deficits got larger and the economy stank. In the 1980s, deficits got larger yet and the economy boomed; in the early 90s there was a recession while the deficits continued unabated. Then the economy boomed again during the Gingrich balanced-budget era and has mostly stank ever since along with still more deficits.

From this chart, we might conclude that government deficit spending has no effect whatsoever on the real economy, for good or for ill. And indeed that's true... until you get to the end of the line.

What Can't Go On, Won't

Consider our spendthrift family example. Suppose that the father totals up the numbers for once and howls in outrage. He rips up everyone's credit cards, starts taking brown bag lunches to work, and makes the kids bicycle to school instead of being driven there. Miracle of miracles, the next month's spending balances out and there's even a small surplus.

Does this mean their finances have improved? The rest of the family sure doesn't think so! Junior didn't get the new iPhone he was expecting, and Sister had to skip a session at the hair salon. From their perspective, the family is significantly poorer - even though, financially, they are measurably richer.

After a couple months of screaming, yelling, and sleeping on the couch, Dad throws up his hands in despair and everything returns to normal - actually a little worse, because of the pent-up demand of three months of thrift. Things go on as before, and everyone is happy.

Except that, each month, a bit more of the income is spent on interest for the debt already accumulated. That money simply vanishes - it doesn't go into assets, clothing, or even consumption like restaurant meals. It just plain disappears off to the bank.

Someday - maybe not soon, but someday - there will come a time when the family has to continue to borrow and also to stop spending, because the total interest charges are so high. Not long thereafter, the credit-card applications will get fewer and farther between, and a time will come when there are no more credit cards and no more borrowing. Then all the debt comes crashing in, and the family has no choice but to file for bankruptcy and live within its means thereafter.

With nations it's never that cut and dried. For one thing, a lot of our "national debt" is owed to ourselves; in fact only about a third is owed to foreigners. Another third is owed to specific Federal accounts, like Social Security - in other words, it is owed mostly to elderly Americans. The rest is owed to state and local governments and individual Americans.

In the family context, that would be like borrowing from your parents as well as the bank. When push comes to shove and you can't pay the money back, probably your mom and dad aren't actually going to foreclose and take your house, though they'll certainly holler at you and you may not be invited to Christmas dinner.

Is the remaining third large enough to be a problem? Well, unlike a bank and your house, China cannot foreclose on the United States.

What they can do, though, is to stop lending any more - indeed, they already have.

We're continuing to borrow, but at some point nobody will lend to us any more. Then it becomes a question of who we want to hurt - or, more accurately, who can hurt us worst if we don't pay them.

That's a good question. For years the assumption has been that Social Security will always be paid, because old folks vote. This might mean that, instead, we'll cut school spending (kids don't vote) or the military (somehow, their absentee ballots don't always show up in time to be counted, at least not during Democratic administrations.)

Or we might stop paying our foreign creditors, but that creates risks too, especially if they provide goods we need and can't make anymore. There have been no TVs manufactured in the US in years; the "Assembled in USA" ones Walmart boasts of are mostly marketing trickery. Maybe we can get better at bringing manufacturing back, and Walmart is certainly trying, but that remains to be seen.

There is one other option, though, and it's one that has a reflection in families too: the number one cause of divorce is money disputes. It is often argued that the real problem is poor communications, but blaming our current national political climate on "poor communications" is like calling Noah's Flood a bit of a damp spell.

This interesting page illustrates the difference between what the 50 states pay to the federal government and what they get back in federal spending. The gap is startling, from New Jersey which gets back only 61 cents for every dollar of taxes all the way up to New Mexico which gets back a startling $2.03 for the same tax bill.

When we run out of money and have to cut back, are the cuts likely to fall evenly? The underpaid states will argue that isn't fair. The overpaid states won't be structured to take up the gap in their budgets when federal dollars go away. The fight will make the culture wars look like a walk in the park, because to most Americans, there's nothing more important than money, not even guns or abortion.

Will there be a divorce? We shall see. If it comes, though, like most divorces, the root cause will be dishonesty - in this case, the prosperity of the 60s and following that was based on lying about deficit spending.

-

Tools:

What does Chinese history have to teach America that Mr. Trump's cabinet doesn't know?

Good analysis. I highly doubt, however, that we still stop any of those things - spending or borrowing - any time soon. China aside, there is a whole lot more borrowing that can be done elsewhere (for instance internally against our own future). We are still quite a ways from Greece because most everyone trusts us to repay what we owe and our GDP still includes a lot of real (non-government) income. You're right that's it coming through.

...."tink"!...

Did you hear that? That's the sound of a can being kicked down the road.

So we will implode from within rather than someone invading our shores and taking over. No news there. What can happen is that when this happens the country will be divided up into

4-5-6 different zones if you will, that are autonomous and will only answer to themselves without a federal government. They might only be linked by the military. We might still have English as a first language but the currency will change. New Jersey can keep all of its tax dollars and New Mexico will have to make some cuts in spending. Regardless the country might just be an economic model for the world to see and copy if this works and I think it will. Southerners are tired of Northerners telling them how to think and live, westerners are tired of southerners and north easterners not paying attention to the environment and the mid west? Well they will have to straighten out their mess on their own. They have the greatest opportunity but have been tied down too long by the unions and corrupt politicians. They will emerge as the best of the new little countries. Will this happen? Only when we as a people quit looking to Washington for answer because history tell us very plainly that they have no answers and only make things worse.