Union Wars Through The Times' Biased Lens

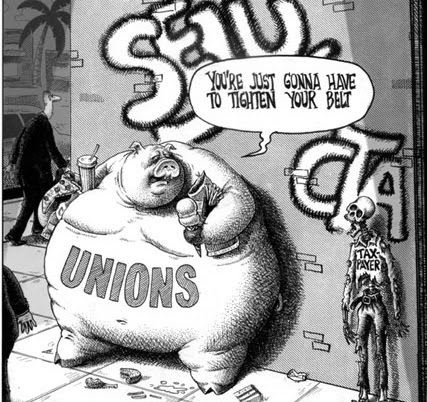

The NY Times wants union workers to ride their gravy train all the way into national bankruptcy.

-

Tools:

The ancient Greeks learned that democracies collapse once citizens learn that they can vote themselves benefits out of the public treasury. The great thinkers who informed our Founders were well aware of this danger. Our Founders tried to guard against it by setting up a republic instead of a democracy.

Despite their best efforts at avoiding the financial dangers of democracy, America has been living beyond our national income for decades as elected officials have tried to win votes by passing out goodies funded by borrowing. Conservatives have warned for years that the bill would fall due, but were ignored.

When the real estate bubble popped in 2008, the bill started falling due - more citizens claimed unemployment benefits while tax receipts fell.

It's fascinating, disheartening, and utterly unsurprising to watch the froth as national, state, and local governments debate what to do about expenses going up as revenue fell. Most predictably yet most grievously, absolutely nobody who's currently collecting from the government wants to give up one red cent. This is true not only in America, but in Europe as well.

Greece

The nation of Greece has been living far beyond its means for years. Vast hordes of unionized government employees retire early with generous pensions and often collect more for not working than they collected while working. Citizens collect subsidies and chronically evade taxes.

To pay the entitlements, the government sold so many bonds that there's no hope of the Greek economy growing enough to pay them off. In the most literal sense, Greece is insolvent: it owes more than it can ever pay.

The best solution for Greece would be to default, wipe out their debts, and start over - that's what deeply-underwater debtors do, and why prudent lenders don't lend to spendthrifts. Unfortunately for the rest of Europe, most Greek bonds are held by European banks. If the Greeks default, European governments would have to bail out their banks with taxpayer money, many of them for the second time.

The first round of bank bailouts was deeply unpopular and led to the fall of governments in Icelandand Ireland. Another round of sending tax dollars paid by the working man to rescue stupid decisions by rich elite bankers would bring on the revolution.

European governments are bailing out the Greeks instead, in the hope that voters hate Greeks less than they hate bankers. Unfortunately, this sleight-of-hand isn't fooling anybody.

European taxpayers are not amused by their leaders going to Greece bearing gifts when, from their perspective, Greeks have been living high at their expense. They've demanded that the Greek government cut pensions, raise taxes, and sell off state-owned businesses. Two German politicians called for Greece to sell off whole islands to private investors at a public auction.

How are the Greeks reacting to having their gravy train cut? They're rioting in the streets. The only way Greek spending will be cut is if the rest of Europe stops giving Greece their money to burn.

United States

The 2010 election gave the Republicans a majority in the US House of Representatives with what voters thought was a mandate to finally shrink overgrown government. Despite massive posturing and bloodcurdling cries of pain from big-government leftists, Congress actually cut spending so little in the last budget that Tea Party activists were enraged.

Instead of waiting until next year to cut the budget, the Republicans appear to have decided not to increase the amount of money the American government is permitted to borrow unless the Democrats agree to matching spending cuts. The Democrats want the debt limit increased without conditions so that they can continue paying off their supporters. Rather than fix the deficit by cutting spending, the Democrats want to increase taxes.

The Republicans withdrew from conversations about the debt limit when it became clear that the Democrats wouldn't accept spending limits without tax increases. The government borrows between a quarter and a half of its spending. If the Treasury can't increase the debt, spending will have to be cut seriously, which is precisely what many Republicans want.

Unfortunately, government at all levels has a time-honored tradition of sticking it to taxpayers whenever there's a crunch by making cuts in the most painful way possible. If the school budget is voted down, it's not the basketweaving instructor or lacrosse coach that gets the sack, but rather the science or English departments. If the town budget must be cut, it's not the bureaucrats and petty officials in City Hall that get the ax, but librarians and park groundskeepers.

There is absolutely no reason for the United States to default on its debts - our government collects far more than enough tax revenues to pay the interest on our debts as they currently stand. However, nothing requires "Turbo Tax Timmy" Geithner to pay our creditors when the choice is between paying creditors or paying off loyal Democrat constituents like welfare recipients and public-sector union workers.

It's entirely conceivable that he will consciously choose to default us if he thinks he can get away with blaming Republicans for the ensuing meltdown. Thus far, he's doing quite well at conning the American people into believing Republicans desire and intend a default; no telling whether the truth will out, or whether Republicans will wimp out as they so often do.

Connecticut

Connecticut has a Democratic governor, Dannel Malloy, who won office with the support of the state employee unions. He and the Democrat-dominated legislature put through the largest tax increases in state history.

In what he called a "balanced approach," Governor Malloy negotiated minor reductions in state employee compensation. The New York Times explained how the unions reacted to the idea of sharing the pain:

HARTFORD — Connecticut’s state workers, in voting results announced on Friday, rejected a deal meant to produce $1.6 billion in labor savings over two years, blowing a gaping hole in the state budget, raising the likelihood of thousands of layoffs and threatening chaos in a state that has largely avoided the rancorous labor issues seen elsewhere.

What were the horrifying cuts that the unions rejected?

The agreement called for wage freezes for two years, followed by 3 percent annual raises for three years and a guarantee of no layoffs for four years, as well as concessions on pensions and health care.

The agreement called for a mere freeze, there were no pay cuts at all! 3% raises starting in two years! No layoffs! These teeny changes would save $1.6 billion over two years! But no, rather than accept this not-a-cut-at-all, the unions declared war.

No shared sacrifice, not in Connecticut. The governor plans to lay off 7,500 state employees instead. It remains to be seen how Connecticut taxpayers will react to future pleas for tax increases, given that the last round bought them nothing whatsoever.

New York and New Jersey

The New York Times contrasts two states:

New York and New Jersey, like so many other states, are struggling with big budget gaps and high health care expenses for union employees. The Cuomo administration in New York sat at the bargaining table and worked out a fair arrangement for bigger contributions by workers. Gov. Chris Christie of New Jersey, by contrast, bullied and postured and got the Legislature to strip unions of collective-bargaining rights on health insurance.

The Times omitted the minor detail that the New York unions haven't agreed to the Governor's proposal; they may turn it down. The Times doesn't approve of Governor Christie's methods:

The New Jersey way may produce short-term financial benefits, but it is not a path toward long-term labor peace or effective state management.

The Times is absolutely right that cramming down the unions is not a path towards labor peace in the short term; the near-riots in Wisconsin amply demonstrated that. However, what the Times doesn't see fit to print is that states which don't tolerate public-sector unionism or which severely restrict it, like Virginia, do have labor peace because there's nobody to declare war. A better way of viewing Gov. Christie's approach in New Jersey is one of total war until total victory, and then a lasting peace afterwards.

Of course, the Times doesn't want Gov. Christie to defeat the unions because his changes will destroy the unions' political power. For many years, public-sector unions have contributed massive amounts of money and resources to electing Democrats; by killing them, Christie will knock the foundation out from under the Democratic party, a horrifying concept to the Times.

It is an objective fact that union political power has pushed public-sector benefits up to unsustainable levels. Reducing unions' clout thus is an essential part of any viable solution, but the Times will have none of it. Apparently they'd rather New Jersey simply go bankrupt with its assets paid out to the unions upon liquidation, just as GM's assets went to their unions while creditors got the finger.

California

The state of California is a poster child for labor union political power. Taxes have gone up to the point that productive Californians are leaving while welfare recipients and illegal immigrants swarm in.

Presented with a gubernatorial choice between a budget-cutting Republican and the selfsame Democratic ex-governor who created the problem by permitting public-sector unions many decades ago, masochistic Californian voters opted for the latter. To our surprise, reinstated Governor Brown actually did plead for budget cuts; predictably, his colleagues in the legislature refused to balance the budget by reducing spending and demanded still more tax increases. Like their federal counterparts, California Republicans blocked higher taxes.

California law requires that the budget be passed by a certain date, and a newly-passed referendum cuts off legislators' pay if the budget doesn't pass on time. With that incentive, the Democrats passed their usual gimmicky unbalanced "budget" which added billions more to the state's debt. To universal amazement, Gov. Brown vetoed his party's budget; to universal stupefaction, State Controller John Chiang followed the law and cancelled the legislators' paychecks.

The legislators whined and cried, but were met with disgust and contempt from the electorate. Abrupt poverty combined with hatred tends to focus the mind. Perhaps even Democrats can understand fiscal reality if the pain gets personal enough.

The Common Enemy: Public Employee Unions

A recent New York Times op-ed argued that public sector unions are just like private sector unions:

As New Jersey throws its weight behind Wisconsin and Ohio in rolling back the collective bargaining rights of public sector employees, we are once again going to hear the argument that public sector unions ought not to be confused with their private sector counterparts. They’re two different animals entirely.

Private sector workers, so the argument goes, have historically organized to win better working conditions and a bigger piece of the pie from profit-making entities like railroads and coal mines. But public sector employees work for “us,” the ultimate nonprofit, and therefore are not entitled to the same protections.

The Times argues that government employees need protection from greedy, exploitative politicians just as private sector workers need protection from greedy, exploitative bosses. The Times is correct in a perverse sort of way in saying that government unions are like private unions: in both cases, union demands increase costs to the point that employers can't afford unionized labor.

Unfortunately, the Times prefers to ignore the giant difference between private and public employers: private companies can and do go broke and vanish, whereas governments almost never declare bankruptcy and virtually never vanish. It's possible - indeed, common - for private-sector unions to bleed their employers out of existence and themselves onto the unemployment line; thus far, public-sector unions have always managed to strongarm higher taxes or a bailout from the next government level up.

Unions have relatively few members in the private sector because unionized businesses go broke. Smart workers have noticed this and are voting against unionization.

Governments have raised taxes to meet whatever the unions demanded ever since JFK allowed unions into government in 1962. Now that the good times are over, the unions are rolling out every fallacious argument in the book to claim that their gravy train should continue regardless of performance. Without the refuge of bankruptcy, voters are the only check on rapacious public-sector unions, but public-sector employees, unlike private-sector union workers, can actually vote for their own bosses.

Readin' and Writin' and Budget Tricks

Teacher's unions are perhaps the most effective of all public sector unions in raising pay without having to deliver performance. A USA Today op-ed argued that poor school performance isn't teachers' fault, it's because parents don't push kids to succeed:

It's in vogue for reformers to blame the achievement gap not on poor parenting but more on poor teaching. New York City, encouraged by the Obama administration, is leading the way. Just last month, it announced that it will spend more than $25 million to devise special tests students will take to measure the effectiveness of their teachers.

Reduced to its simplest terms, the rationale behind the attack on teachers is this: Children born to single, semi-literate, poverty-stricken 16- or 17-year-olds can, with the right teachers, reach the same level of academic skill as children born to parents such as Ben's and Emma's [two of his students who went to good colleges]. ...

The article absolves unionized teachers for any responsibility for poor student performance. That's nonsense for two reasons. First, today's parents passed through the school system 20 years ago. If today's parents are irresponsible, it's because they weren't properly educated by the school system back then.

Second, experience with school vouchers in Washington, DC, showed that sending poor DC school kids to private schools improved their performance for less money than it cost to fail to educate them in government schools.

To counter the self-serving union argument that the voucher kids performed better because their parents cared enough to sign them up, scores were compared between kids who won places in the voucher program and kids who applied but were not admitted.

Parental encouragement helps, of course. It's also clear that USA Today is advancing a straw man argument - nobody expects anyone to teach impoverished kids as much as kids from more advantaged backgrounds learn, but the facts show it's perfectly possible to do it if you try.

Even though the Obama administration tried to suppress the results, the DC program shows that teachers who can be fired teach better than teachers who can't, and for less money. Surprise!

The War Is On

The war between taxpayers and government employees is well begun. The Wisconsin public-sector unions are trying to recall the Wisconsin governor (R) who promoted the law that stopped the state from collecting union dues. Unions in other states are suing to prevent their pay from being cut. Victory will go to the side that is most determined.

For fifty years that's been the unions, but now that taxpayers have been fleeced down to the bare skin, it's just possible that the silent majority has had enough. It's time for Americans to learn the lesson the New York Times learned forty years ago - when the Times broke its own unions.

-

Tools:

What does Chinese history have to teach America that Mr. Trump's cabinet doesn't know?

"The nation of Greece has been living far beyond its means for years. Vast hordes of unionized government employees retire early with generous pensions and often collect more for not working than they collected while working. Citizens collect subsidies and chronically evade taxes."

Why shouldn't everybody avoid--in fact refuse to pay taxes in a criminal usurious system such as this IMF scam?

You are blaming the victims, when the real criminals are the international banking cabal. They are the ones who set up this numbers game and enforce it with shock and awe austerity--backed up with NATO bombs when it comes to it.

These debts should be reputiated by the people world wide--not defaulted, but repudiated.

ww

It is simply spurious crap to blame unions for the crimes of the bankers that have left this nation in the debt abyss.

It is absurd to the point of insanity.

ww

So Willie, why do you think the taxpayers must overpay greedy unions? Why shouldn't government work go to the lowest bidder instead of a union monopoly?

I don't think "the taxpayer" should be the taxpayer Patience.

Isn't that clear from what I have already said?

"Greedy unions" are simply the antithesis of the greedy banking cartel.

A truly free and informed people need neither.

But once you have monopolism, you are going to have an attempt to counter that--this is where the union movement came from in this nation, because the "government" was captured by the banking cabal again in 1913.

It took the financial manipulations of divide and conquer to finally set the nation aflame in a civil war, after Jackson had defeated the central bank. The bankers finally got their "Federal Reserve" in 1913, after the plot at Jekyll Island in 1910. There is nothing "Federal" about this cartel--it is a private international corporation. There are no "reserves" only usurious debt.

This is the core scam that needs to be busted.

But it is too late for that.

A great catastrophy is at hand NOW.

Pay attention as the midwest is put under martial law due to this "natural emergency" of flooding. Most likely occuring as early as the middle of this month.

I won't expect you to pay attention until it already comes to pass.

And then you will buy the excuses given by the mainstream media yet again.Meanwhile the country will be effectively cut in half--east from west.

Being behind the curve on this is dangerous to your health and well being. Don't say you haven't been warned.

ww

The taxpayers were robbed when the banks were bailed out.

The taxpayers are robbed on an ongoing basis by public-sector unions.

What's wrong with being opposed to both?

Why do you support the austerity attrition?

That is my question. The union situation is miniscule compared to what the bankers and the so-called 'governments' are up to.

Count on this, they are not only crushing the unions, they are crushing all of us. You promote the first line of attack and will end up leaving yourself in the open as next in line.

Again, you fall for the divide and conquer of the "little people"...

ww

http://globalresearch.ca/index.php?context=va&aid=25391

"The Treasury stopped borrowing in mid-May, when it reached the current debt ceiling of $14.3 trillion. Treasury Secretary Timothy Geithner said that one-time financial maneuvers could sustain federal government operations through August 2, but there will be no funds to cover Social Security checks to be sent out August 3 unless the debt ceiling is raised."

Why not? The Social Security Fund is not the governments money to play with.

This is a scam--the G has no authority to play with that money--but of course they have raided the piggy bank because they are criminals who think they can do anything they want. They got their storm troopers in place. They can throw this nation into austerity chaos now, and just put the people thrown into the street in their FEMA camps.

Yes, I know that the SS Fund was maneuvered into the "general fund"--but that was clearly unlawful. Just like privatizing the other retirement funds.

They are going to strip everyone bare--it is highway robbery by the "authorities" themselves.

And you sit there distracted by this pittance the unions have had...what utter nonsense.

ww

I'm just wondering what you think about "trickle down economics" now Patience?

Or as it is called by the Latin American oligarchs, "Feeding the birds through the horses."

Do you still think the major international corporations should continue paying zero, while the average Joe is smacked with a quarter of his earnings going to feed the federal golem? None of that money goes to the government you know--it all goes to pay off the "debt."

As has been explained so many times, this 'debt' is simple coersion by a numbers racket--backed up by the protection racket of this police state.

Until Americans understand who the real enemy is this isn't going to stop.

You can pennyantie musical chair with the 'unions' and all the other minor players all you want and nothing will change until this rip off bankers game is crushed.

ww

What we need IS some trickle-down economics - the wealthy people who own and start businesses won't invest or hire with Obama, and you, ranting about higher taxes on them.

And how many times does this have to be said - BUSINESSES PAY NO TAXES. They only collect and remit them; they pass the full cost on to their customers or their employees.

What we need are draconian cuts in government spending. That eliminates the debt problem AND the taxing problem.

"BUSINESSES PAY NO TAXES. They only collect and remit them; they pass the full cost on to their customers or their employees."~Patience

This is only true of retail. I'm talking about the huge amounts of taxes that the International Corporations are given a pass on.

You should know as well as I that Wall Street and the large banks were bailed out--not main street. It is the banks that won't lend, that is where the logjam is.

You refer to "the government," there is no such thing, it is a criminal syndicate fronting for the International Banking Cabal. This is where all the 'money' went. It is a ponzi scheme. This is a set-up, it is out in the open record.

I know you hate the word "paradigm"...so I won't mention it {grin}.

ww

At you admit that the unions AND the banks are greedy. Everyone is greedy, thta is a given. What people do about it not always a given.

"This is only true of retail. I'm talking about the huge amounts of taxes that the International Corporations are given a pass on"

Willy, as with most issues you've debated here on Scragged, you understand only 10% of the issue which misdirects your conclusion.

What Patience meant by "corporations don't pay taxes" is the economic theory that since corporations are in business to make money, anything that stands in the way of profit will be compensated for by increasing the price to the consumer. For large and medium size corporations, this is usually true.

Patience was not referring to "sales and use tax" that you pay at the register. Totally different thing.

I found these articles on the subject in the (vast) Scragged archives:

http://www.scragged.com/articles/big-companies-pass-the-buck

http://www.scragged.com/articles/corporate-taxes-that-hurt-you